Try Fund Library Premium

For Free with a 30 day trial!

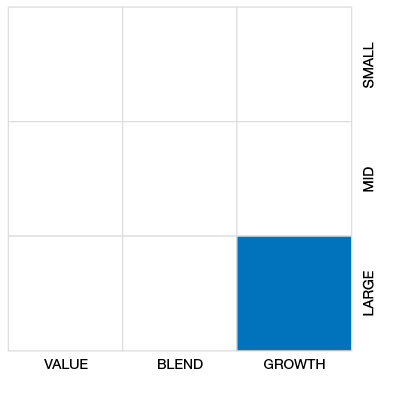

Global Equity

Click for more information on Fundata’s FundGrade

Click for more information on Fundata’s FundGrade

Click for more information on Fundata’s FundGrade.

|

NAVPS (12-12-2025) |

$9.42 |

|---|---|

| Change |

$0.00

(-0.04%)

|

As at November 30, 2025

As at November 30, 2025

Inception Return (August 02, 2022): 4.09%

| Row Heading | Return | Annualized Return | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 Mth | 3 Mth | 6 Mth | YTD | 1 Yr | 2 Yr | 3 Yr | 4 Yr | 5 Yr | 6 Yr | 7 Yr | 8 Yr | 9 Yr | 10 Yr | |

| Fund | 0.21% | 0.66% | 1.64% | 2.51% | 2.60% | 3.43% | 4.13% | - | - | - | - | - | - | - |

| Benchmark | -0.21% | 7.43% | 16.77% | 17.66% | 17.83% | 23.70% | 19.82% | 12.53% | 13.51% | 13.27% | 13.30% | 11.82% | 12.70% | 11.89% |

| Category Average | 0.01% | 5.40% | 12.16% | 13.81% | 12.32% | 18.48% | 14.92% | 8.75% | 10.15% | 10.11% | 10.34% | 8.95% | 9.78% | 9.04% |

| Category Rank | 1,081 / 2,157 | 2,017 / 2,126 | 2,025 / 2,100 | 1,947 / 2,066 | 1,896 / 2,065 | 1,945 / 1,954 | 1,832 / 1,840 | - | - | - | - | - | - | - |

| Quartile Ranking | 3 | 4 | 4 | 4 | 4 | 4 | 4 | - | - | - | - | - | - | - |

| Return % | Dec | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Fund | 0.09% | 0.40% | 0.06% | -0.13% | -0.26% | 0.79% | 0.48% | 0.27% | 0.23% | 0.21% | 0.24% | 0.21% |

| Benchmark | 0.14% | 3.94% | -1.04% | -4.18% | -2.97% | 5.37% | 3.64% | 2.87% | 1.95% | 4.75% | 2.78% | -0.21% |

2.20% (October 2022)

-1.75% (September 2022)

| Return % | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|---|---|---|---|

| Fund | - | - | - | - | - | - | - | - | 5.65% | 3.98% |

| Benchmark | 16.88% | 5.18% | 16.29% | -1.79% | 21.41% | 13.15% | 17.62% | -12.64% | 19.37% | 26.84% |

| Category Average | 8.98% | 3.86% | 14.23% | -5.38% | 19.94% | 11.73% | 16.21% | -13.86% | 15.08% | 20.13% |

| Quartile Ranking | - | - | - | - | - | - | - | - | 4 | 4 |

| Category Rank | - | - | - | - | - | - | - | - | 1,779/ 1,840 | 1,945/ 1,954 |

5.65% (2023)

3.98% (2024)

| Name | Percent |

|---|---|

| Cash and Equivalents | 73.61 |

| Canadian Equity | 13.83 |

| Canadian Corporate Bonds | 8.92 |

| Canadian Government Bonds | 4.28 |

| International Equity | -0.02 |

| Name | Percent |

|---|---|

| Cash and Cash Equivalent | 73.61 |

| Fixed Income | 13.20 |

| Energy | 10.12 |

| Other | 3.07 |

| Name | Percent |

|---|---|

| North America | 100.12 |

| Europe | -0.12 |

| Name | Percent |

|---|---|

| NINEPOINT CASH MGMT I NPP219 | 56.65 |

| Pembina Pipeline Corp 3.71% 11-Aug-2026 | 7.04 |

| Tourmaline Oil Corp | 6.42 |

| New York Life Global Funding 3.67% 30-Jun-2026 | 5.00 |

| ENBRIDGE INC DISC 25 | 4.95 |

| Penske Truck Leasng Canada Inc 5.44% 08-Dec-2025 | 4.32 |

| Canadian Treasury Bill | 4.28 |

| Tourmaline Oil Corp | 2.72 |

| Enbridge Pipelines Inc 3.00% 10-Aug-2026 | 1.88 |

| Canadian Dollar | 1.82 |

Ninepoint Target Income Fund Series A

Median

Other - Global Equity

| Standard Deviation | 0.89% | - | - |

|---|---|---|---|

| Beta | 0.07% | - | - |

| Alpha | 0.03% | - | - |

| Rsquared | 0.57% | - | - |

| Sharpe | 0.16% | - | - |

| Sortino | 2.41% | - | - |

| Treynor | 0.02% | - | - |

| Tax Efficiency | - | - | - |

| Volatility |

|

- | - |

| Key Ratio | 1 Yr | 3 Yr | 5 Yr | 10 Yr |

|---|---|---|---|---|

| Standard Deviation | 0.95% | 0.89% | - | - |

| Beta | 0.08% | 0.07% | - | - |

| Alpha | 0.01% | 0.03% | - | - |

| Rsquared | 0.75% | 0.57% | - | - |

| Sharpe | -0.14% | 0.16% | - | - |

| Sortino | -0.62% | 2.41% | - | - |

| Treynor | -0.02% | 0.02% | - | - |

| Tax Efficiency | 21.05% | - | - | - |

| Start Date | August 02, 2022 |

|---|---|

| Instrument Type | Mutual Fund |

| Share Class | Commission Based Advice |

| Legal Status | Trust |

| Sales Status | Open |

| Currency | CAD |

| Distribution Frequency | Monthly |

| Assets ($mil) | - |

| FundServ Code | Load Code | Sales Status |

|---|---|---|

| NPP5001 |

The investment objective of the Ninepoint Target Income Fund is to seek to provide unitholders with stable, monthly distributions and lower volatility than a direct investment in the broad equity markets by investing primarily in a diversified portfolio of equity index based investments that generates income and using derivatives strategies to moderate the market volatility of those investments.

The Fund seeks to generate income by primarily selling put options on broad equity indices, including exchange-traded funds (ETFs). In addition, the Portfolio Manager enters into, or obtains exposure to, systematic put selling strategies through the use of derivative instruments, such as swaps.

| Portfolio Manager |

Ninepoint Partners LP

|

|---|---|

| Sub-Advisor |

- |

| Fund Manager |

Ninepoint Partners LP |

|---|---|

| Custodian |

CIBC Mellon Trust Company |

| Registrar |

- |

| Distributor |

- |

| RSP Eligible | Yes |

|---|---|

| PAC Allowed | Yes |

| PAC Initial Investment | 500 |

| PAC Subsequent | 25 |

| SWP Allowed | No |

| SWP Min Balance | - |

| SWP Min Withdrawal | - |

| MER | 2.37% |

|---|---|

| Management Fee | 1.60% |

| Load | Back Fee Only |

| FE Max | 5.00% |

| DSC Max | - |

| Trailer Fee Max (FE) | 1.00% |

| Trailer Fee Max (DSC) | - |

| Trailer Fee Max (NL) | - |

| Trailer Fee Max (LL) | - |

Try Fund Library Premium

For Free with a 30 day trial!