Try Fund Library Premium

For Free with a 30 day trial!

Canadian Equity Balanced

Click for more information on Fundata’s FundGrade

Click for more information on Fundata’s FundGrade

Click for more information on Fundata’s FundGrade.

|

NAVPS (01-29-2026) |

$19.50 |

|---|---|

| Change |

-$0.18

(-0.89%)

|

As at December 31, 2025

As at November 30, 2025

Inception Return (December 31, 2005): 8.90%

| Row Heading | Return | Annualized Return | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 Mth | 3 Mth | 6 Mth | YTD | 1 Yr | 2 Yr | 3 Yr | 4 Yr | 5 Yr | 6 Yr | 7 Yr | 8 Yr | 9 Yr | 10 Yr | |

| Fund | 1.10% | 5.07% | 14.64% | 18.74% | 18.74% | 18.24% | 14.73% | 9.90% | 12.19% | 11.48% | 12.24% | 8.87% | 8.50% | 8.93% |

| Benchmark | 0.65% | 4.58% | 14.68% | 23.78% | 23.78% | 20.40% | 17.00% | 10.44% | 11.84% | 10.99% | 12.08% | 9.59% | 9.36% | 10.00% |

| Category Average | 0.03% | 1.83% | 6.57% | 11.54% | 11.54% | 12.23% | 11.38% | 6.25% | 8.02% | 7.47% | 8.43% | 6.42% | 6.39% | 6.80% |

| Category Rank | 38 / 392 | 21 / 392 | 16 / 392 | 39 / 372 | 39 / 372 | 32 / 368 | 64 / 366 | 36 / 362 | 21 / 354 | 17 / 327 | 18 / 319 | 36 / 299 | 45 / 270 | 37 / 261 |

| Quartile Ranking | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| Return % | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Fund | -0.23% | -2.66% | -0.33% | -0.02% | 3.30% | 3.62% | 1.14% | 3.23% | 4.51% | -0.46% | 4.41% | 1.10% |

| Benchmark | 2.89% | -0.02% | -1.20% | -0.27% | 4.19% | 2.20% | 1.08% | 3.81% | 4.50% | 0.91% | 2.96% | 0.65% |

12.92% (April 2020)

-24.98% (March 2020)

| Return % | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 |

|---|---|---|---|---|---|---|---|---|---|---|

| Fund | 12.92% | 5.56% | -12.05% | 16.91% | 8.03% | 21.85% | -3.42% | 8.02% | 17.74% | 18.74% |

| Benchmark | 15.95% | 7.50% | -6.34% | 18.83% | 6.85% | 17.62% | -7.12% | 10.48% | 17.11% | 23.78% |

| Category Average | 10.63% | 6.12% | -6.63% | 14.36% | 4.77% | 15.38% | -7.74% | 9.70% | 12.92% | 11.54% |

| Quartile Ranking | 2 | 3 | 4 | 1 | 2 | 1 | 1 | 4 | 1 | 1 |

| Category Rank | 77/ 261 | 180/ 270 | 292/ 299 | 71/ 319 | 112/ 327 | 45/ 354 | 49/ 362 | 295/ 366 | 35/ 368 | 39/ 372 |

21.85% (2021)

-12.05% (2018)

| Name | Percent |

|---|---|

| Canadian Equity | 75.76 |

| Income Trust Units | 9.55 |

| Cash and Equivalents | 7.83 |

| Canadian Corporate Bonds | 4.08 |

| Foreign Corporate Bonds | 2.44 |

| Other | 0.34 |

| Name | Percent |

|---|---|

| Energy | 21.04 |

| Real Estate | 19.62 |

| Financial Services | 10.80 |

| Consumer Goods | 8.05 |

| Industrial Services | 7.90 |

| Other | 32.59 |

| Name | Percent |

|---|---|

| North America | 99.99 |

| Europe | 0.01 |

| Name | Percent |

|---|---|

| BANK OF NOVA SCOTIA TD 2.00% 01-Dec-2025 | 6.52 |

| Alamos Gold Inc Cl A | 5.37 |

| Stingray Group Inc | 4.90 |

| Exchange Income Corp | 4.12 |

| Dexterra Group Inc | 4.04 |

| Alaris Equity Partners Income Trust - Units | 3.98 |

| SECURE Waste Infrastructure Corp | 3.78 |

| Sprott Inc | 3.49 |

| Black Diamond Group Ltd | 3.47 |

| KIPLING ST INC KIP1105 CL M | 3.27 |

NCM Income Growth Class Series A

Median

Other - Canadian Equity Balanced

| Standard Deviation | 7.97% | 9.82% | 14.26% |

|---|---|---|---|

| Beta | 0.71% | 0.83% | 1.14% |

| Alpha | 0.03% | 0.02% | -0.02% |

| Rsquared | 0.68% | 0.69% | 0.66% |

| Sharpe | 1.29% | 0.95% | 0.55% |

| Sortino | 3.07% | 1.58% | 0.64% |

| Treynor | 0.15% | 0.11% | 0.07% |

| Tax Efficiency | 87.79% | 85.80% | 79.44% |

| Volatility |

|

|

|

| Key Ratio | 1 Yr | 3 Yr | 5 Yr | 10 Yr |

|---|---|---|---|---|

| Standard Deviation | 7.97% | 7.97% | 9.82% | 14.26% |

| Beta | 0.95% | 0.71% | 0.83% | 1.14% |

| Alpha | -0.03% | 0.03% | 0.02% | -0.02% |

| Rsquared | 0.60% | 0.68% | 0.69% | 0.66% |

| Sharpe | 1.88% | 1.29% | 0.95% | 0.55% |

| Sortino | 4.70% | 3.07% | 1.58% | 0.64% |

| Treynor | 0.16% | 0.15% | 0.11% | 0.07% |

| Tax Efficiency | 89.79% | 87.79% | 85.80% | 79.44% |

| Start Date | December 31, 2005 |

|---|---|

| Instrument Type | Mutual Fund |

| Share Class | Commission Based Advice |

| Legal Status | Corporation |

| Sales Status | Capped |

| Currency | CAD |

| Distribution Frequency | Monthly |

| Assets ($mil) | $117 |

| FundServ Code | Load Code | Sales Status |

|---|---|---|

| NRP501 | ||

| NRP502 |

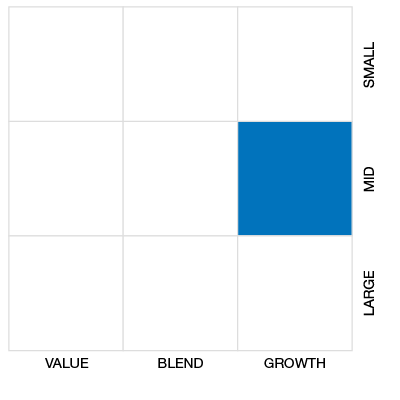

The Fund is designed to provide investors with a stable monthly stream of cash distributions, which shall be determined on an annual basis by the Manager, and the potential for long term capital appreciation by investing in small and mid capitalization high yield securities.

The Fund uses a value approach to high yield investments as a primary method to securities selection. This means searching for organizations that are able to maintain and grow their distributions. In addition we will look for organizations offering superior long-term earnings and cash flow per share growth, organizations exhibiting a strong position in the markets in which they operate, quality management, and balance sheet strength.

| Portfolio Manager |

NCM Asset Management Ltd. |

|---|---|

| Sub-Advisor |

Cumberland Investment Counsel Inc. |

| Fund Manager |

NCM Asset Management Ltd. |

|---|---|

| Custodian |

CIBC Mellon Trust Company |

| Registrar |

CIBC Mellon Global Securities Services Company |

| Distributor |

- |

| RSP Eligible | Yes |

|---|---|

| PAC Allowed | Yes |

| PAC Initial Investment | 5,000 |

| PAC Subsequent | 100 |

| SWP Allowed | Yes |

| SWP Min Balance | 0 |

| SWP Min Withdrawal | 0 |

| MER | 2.25% |

|---|---|

| Management Fee | 1.65% |

| Load | Choice of Front or No Load |

| FE Max | 5.00% |

| DSC Max | 3.00% |

| Trailer Fee Max (FE) | 0.65% |

| Trailer Fee Max (DSC) | 0.65% |

| Trailer Fee Max (NL) | - |

| Trailer Fee Max (LL) | - |

Try Fund Library Premium

For Free with a 30 day trial!