Try Fund Library Premium

For Free with a 30 day trial!

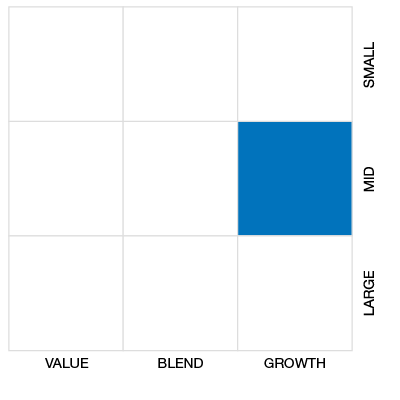

Global Small/Mid Cap Eq

Click for more information on Fundata’s FundGrade

Click for more information on Fundata’s FundGrade

Click for more information on Fundata’s FundGrade.

|

Close (12-12-2025) |

$10.20 |

|---|---|

| Change |

-$0.28

(-2.67%)

|

| Open | $10.38 |

|---|---|

| Day Range | $10.18 - $10.38 |

| Volume | 2,195 |

As at November 30, 2025

As at November 30, 2025

Inception Return (January 11, 2021): -12.73%

| Row Heading | Return | Annualized Return | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 Mth | 3 Mth | 6 Mth | YTD | 1 Yr | 2 Yr | 3 Yr | 4 Yr | 5 Yr | 6 Yr | 7 Yr | 8 Yr | 9 Yr | 10 Yr | |

| Fund | -3.15% | 15.56% | 35.81% | 33.15% | 25.95% | 6.22% | -8.64% | -10.62% | - | - | - | - | - | - |

| Benchmark | 0.81% | 4.33% | 14.10% | 12.91% | 9.46% | 18.95% | 14.19% | 8.26% | 9.98% | 9.64% | 9.85% | 8.28% | 9.39% | 9.08% |

| Category Average | 0.70% | 11.04% | 11.04% | 12.89% | 10.04% | 15.40% | 11.71% | 5.30% | 7.30% | 7.87% | 7.53% | 5.89% | 6.72% | 6.36% |

| Category Rank | 271 / 284 | 7 / 276 | 7 / 276 | 34 / 268 | 36 / 267 | 224 / 255 | 237 / 237 | 226 / 226 | - | - | - | - | - | - |

| Quartile Ranking | 4 | 1 | 1 | 1 | 1 | 4 | 4 | 4 | - | - | - | - | - | - |

| Return % | Dec | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Fund | -5.41% | -1.74% | -2.15% | -2.32% | -3.19% | 7.83% | 5.19% | 8.52% | 2.96% | 7.92% | 10.56% | -3.15% |

| Benchmark | -3.05% | 4.42% | -3.55% | -4.14% | -3.02% | 5.68% | 3.76% | 2.68% | 2.65% | 2.67% | 0.79% | 0.81% |

14.79% (May 2024)

-14.40% (January 2022)

| Return % | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|---|---|---|---|

| Fund | - | - | - | - | - | - | - | -15.03% | -22.24% | -21.33% |

| Benchmark | 16.61% | 7.47% | 15.40% | -7.34% | 20.09% | 11.07% | 15.50% | -13.14% | 14.59% | 18.68% |

| Category Average | 9.56% | 3.48% | 12.62% | -10.42% | 13.76% | 14.53% | 12.37% | -15.59% | 12.82% | 12.04% |

| Quartile Ranking | - | - | - | - | - | - | - | 2 | 4 | 4 |

| Category Rank | - | - | - | - | - | - | - | 106/ 226 | 237/ 237 | 255/ 255 |

-15.03% (2022)

-22.24% (2023)

| Name | Percent |

|---|---|

| International Equity | 61.52 |

| US Equity | 32.72 |

| Canadian Equity | 3.29 |

| Cash and Equivalents | 2.47 |

| Name | Percent |

|---|---|

| Utilities | 40.57 |

| Energy | 30.85 |

| Industrial Goods | 13.19 |

| Technology | 9.65 |

| Cash and Cash Equivalent | 2.47 |

| Other | 3.27 |

| Name | Percent |

|---|---|

| North America | 38.48 |

| Europe | 36.34 |

| Asia | 22.20 |

| Africa and Middle East | 2.97 |

| Other | 0.01 |

| Name | Percent |

|---|---|

| Eos Energy Enterprises Inc Cl A | 5.30 |

| Fluence Energy Inc Cl A | 4.80 |

| Sunrun Inc | 4.23 |

| EnerSys | 3.51 |

| First Solar Inc | 3.39 |

| Solaria Energia y Medio Ambiente SA | 3.37 |

| Daqo New Energy Corp - ADR | 3.36 |

| Solaredge Technologies Inc | 2.97 |

| Verbio Vereinigte Bioenergie AG | 2.82 |

| Ormat Technologies Inc | 2.70 |

Harvest Clean Energy ETF - Class A Units

Median

Other - Global Small/Mid Cap Eq

| Standard Deviation | 23.48% | - | - |

|---|---|---|---|

| Beta | 1.11% | - | - |

| Alpha | -0.22% | - | - |

| Rsquared | 0.36% | - | - |

| Sharpe | -0.44% | - | - |

| Sortino | -0.54% | - | - |

| Treynor | -0.09% | - | - |

| Tax Efficiency | - | - | - |

| Volatility |

|

- | - |

| Key Ratio | 1 Yr | 3 Yr | 5 Yr | 10 Yr |

|---|---|---|---|---|

| Standard Deviation | 19.65% | 23.48% | - | - |

| Beta | 1.06% | 1.11% | - | - |

| Alpha | 0.15% | -0.22% | - | - |

| Rsquared | 0.41% | 0.36% | - | - |

| Sharpe | 1.14% | -0.44% | - | - |

| Sortino | 2.60% | -0.54% | - | - |

| Treynor | 0.21% | -0.09% | - | - |

| Tax Efficiency | 100.00% | - | - | - |

| Start Date | January 11, 2021 |

|---|---|

| Instrument Type | Exchange Traded Fund (Responsible Investment) |

| Share Class | Do-It-Yourself |

| Legal Status | Trust |

| Sales Status | Open |

| Currency | CAD |

| Distribution Frequency | Annual |

| Assets ($mil) | $20 |

| 52 Week High | $11.20 |

| 52 Week Low | $6.43 |

| Annual Dividend | - |

| Annual Yield | - |

| Index | - |

| Shares Outstanding | - |

| Registered Plan Eligible | Yes |

| Exposure | - |

|---|---|

| Asset Class High | - |

| Asset Class Medium | - |

| Asset Class Low | - |

| Leveraged | - |

| Inverse | - |

| Advisor Series | - |

| Covered Call Strategy | No |

The Harvest Clean Energy ETF investment objective is to provide Unitholders with the opportunity for capital appreciation. The Harvest Clean Energy ETF primarily invests in issuers that are engaged in clean energy related businesses that are listed on a regulated stock exchange in select North American, Asian or European countries.

The Harvest Clean Energy ETF invests in an equally weighted portfolio of Equity Securities of 40 Clean Energy Issuers chosen from the Clean Energy Investable Universe that, immediately following each semi-annual reconstitution, rank in the top 40 issuers as measured by market capitalization on an equally weighted basis (in Canadian dollars based on the most recent month-end value) and in the determination of the Manager, have sufficient liquidity to meet the Harvest Clean Energy ETF’s objectives

| Portfolio Manager |

Harvest Portfolios Group Inc. |

|---|---|

| Sub-Advisor |

- |

| Fund Manager |

Harvest Portfolios Group Inc. |

|---|---|

| Custodian |

State Street Trust Company Canada |

| Registrar |

State Street Trust Company Canada |

| Distributor |

- |

| MER | 0.69% |

|---|---|

| Management Fee | 0.40% |

Try Fund Library Premium

For Free with a 30 day trial!