Join Fund Library now and get free access to personalized features to help you manage your investments.

Cdn Small/Mid Cap Equity

Click for more information on Fundata’s FundGrade

Click for more information on Fundata’s FundGrade

Click for more information on Fundata’s FundGrade.

Click for more information on Fundata’s ESG Grade

Click for more information on Fundata’s ESG Grade

Click for more information on Fundata’s ESG Grade.

|

NAVPS (05-08-2024) |

$9.54 |

|---|---|

| Change |

$0.02

(0.23%)

|

As at April 30, 2024

As at March 31, 2024

As at February 29, 2024

Inception Return (July 12, 2021): 3.49%

| Row Heading | Return | Annualized Return | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 Mth | 3 Mth | 6 Mth | YTD | 1 Yr | 2 Yr | 3 Yr | 4 Yr | 5 Yr | 6 Yr | 7 Yr | 8 Yr | 9 Yr | 10 Yr | |

| Fund | 0.21% | 6.44% | 16.95% | 6.72% | 8.09% | 4.63% | - | - | - | - | - | - | - | - |

| Benchmark | 0.17% | 8.50% | 17.60% | 8.10% | 9.69% | 0.65% | 2.64% | 15.86% | 7.92% | 5.32% | 4.57% | 5.57% | 5.07% | 3.57% |

| Category Average | -1.96% | 16.15% | 16.15% | 4.43% | 8.19% | 3.48% | 2.22% | 12.84% | 6.99% | 5.41% | 4.74% | 5.51% | 4.28% | 3.85% |

| Category Rank | 8 / 211 | 21 / 208 | 96 / 208 | 29 / 208 | 113 / 207 | 102 / 205 | - | - | - | - | - | - | - | - |

| Quartile Ranking | 1 | 1 | 2 | 1 | 3 | 2 | - | - | - | - | - | - | - | - |

| Return % | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Jan | Feb | Mar | Apr |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Fund | -4.04% | 2.71% | 2.70% | -1.79% | -3.88% | -3.27% | 6.62% | 2.78% | 0.26% | 0.79% | 5.38% | 0.21% |

| Benchmark | -4.06% | 0.59% | 6.09% | -1.31% | -5.24% | -2.58% | 4.84% | 3.76% | -0.37% | 0.77% | 7.49% | 0.17% |

8.23% (January 2023)

-10.66% (June 2022)

| Return % | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|---|---|---|---|---|

| Fund | - | - | - | - | - | - | - | - | -9.91% | 9.73% |

| Benchmark | -2.34% | -13.31% | 38.48% | 2.75% | -18.17% | 15.84% | 12.87% | 20.27% | -9.29% | 4.79% |

| Category Average | 3.45% | -6.13% | 18.01% | 3.43% | -15.15% | 16.59% | 11.91% | 22.35% | -11.32% | 6.49% |

| Quartile Ranking | - | - | - | - | - | - | - | - | 2 | 2 |

| Category Rank | - | - | - | - | - | - | - | - | 81/ 204 | 72/ 207 |

9.73% (2023)

-9.91% (2022)

| Name | Percent |

|---|---|

| Canadian Equity | 86.12 |

| Income Trust Units | 10.22 |

| Cash and Equivalents | 3.65 |

| Other | 0.01 |

| Name | Percent |

|---|---|

| Basic Materials | 24.58 |

| Energy | 15.12 |

| Real Estate | 13.82 |

| Financial Services | 10.76 |

| Utilities | 7.31 |

| Other | 28.41 |

| Name | Percent |

|---|---|

| North America | 98.65 |

| Latin America | 1.34 |

| Other | 0.01 |

| Name | Percent |

|---|---|

| MEG Energy Corp | 4.26 |

| Alamos Gold Inc Cl A | 2.82 |

| Descartes Systems Group Inc | 2.32 |

| Prairiesky Royalty Ltd | 2.25 |

| SNC-Lavalin Group Inc | 2.23 |

| FirstService Corp | 2.18 |

| Kinross Gold Corp | 2.13 |

| Ivanhoe Mines Ltd Cl A | 2.10 |

| iA Financial Corp Inc | 2.08 |

| TMX Group Ltd | 2.04 |

| Standard Deviation | - | - | - |

|---|---|---|---|

| Beta | - | - | - |

| Alpha | - | - | - |

| Rsquared | - | - | - |

| Sharpe | - | - | - |

| Sortino | - | - | - |

| Treynor | - | - | - |

| Tax Efficiency | - | - | - |

| Volatility | - | - | - |

| Key Ratio | 1 Yr | 3 Yr | 5 Yr | 10 Yr |

|---|---|---|---|---|

| Standard Deviation | - | - | - | - |

| Beta | - | - | - | - |

| Alpha | - | - | - | - |

| Rsquared | - | - | - | - |

| Sharpe | - | - | - | - |

| Sortino | - | - | - | - |

| Treynor | - | - | - | - |

| Tax Efficiency | - | - | - | - |

The E, S, and G scores are averaged for each security in the portfolio, to arrive at an ESG score for each security. We take the portfolio weighted average of the ESG scores for each fund and rank them against their peers to arrive at the Fundata ESG Score from 0-100.

Three scores under the Environment bucket are averaged to yield the Fundata Environment Score for each fund from 0-100: (1) Pollution Prevention, (2) Environmental Transparency, (3) Resource Efficiency.

Six scores under the Social bucket are averaged to yield the Fundata Social Score for each fund from 0-100. (1) Compensation and Satisfaction, (2) Diversity and Rights, (3) Education and Work Conditions, (4) Community and Charity, (5) Human Rights, (6) Sustainability Integration.

Three scores under the governance bucket are averaged to yield the Fundata Governance Score for each fund from 0-100: (1) Board Effectiveness, (2) Management Ethics, (3) Disclosure and Accountability.

Powered by OWL Analytics. For more information, please contact Fundata Canada.

| Start Date | July 12, 2021 |

|---|---|

| Instrument Type | Mutual Fund |

| Share Class | Do-It-Yourself |

| Legal Status | Trust |

| Sales Status | Open |

| Currency | CAD |

| Distribution Frequency | Quarterly |

| Assets ($mil) | $442 |

| FundServ Code | Load Code | Sales Status |

|---|---|---|

| RBF5314 |

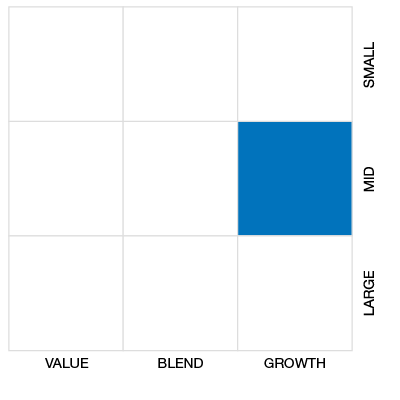

The objective of the fund is to provide long-term total returns primarily consisting of capital appreciation. The fund invests primarily in equity securities of mid-sized Canadian companies that offer above average prospects for growth. The fund may also invest in smaller capitalization companies that have adequate liquidity.

The fund’s investment process is primarily based on fundamental research, although the portfolio manager will also consider quantitative and technical factors. Stock selection decisions are ultimately based on an understanding of the company, its business and its outlook.

| Name | Start Date |

|---|---|

| Marcello Montanari | 08-21-2003 |

| Martin Paleczny | 08-21-2003 |

| Shanthu David | 12-03-2021 |

| Jeffrey Schok | 03-18-2024 |

| Fund Manager | RBC Global Asset Management Inc. |

|---|---|

| Advisor | RBC Global Asset Management Inc. |

| Custodian | RBC Investor Services Trust (Canada) |

| Registrar | RBC Global Asset Management Inc. |

| Distributor | RBC Global Asset Management Inc. |

| Auditor | PriceWaterhouseCoopers LLP |

| RSP Eligible | Yes |

|---|---|

| PAC Allowed | Yes |

| PAC Initial Investment | - |

| PAC Subsequent | - |

| SWP Allowed | Yes |

| SWP Min Balance | - |

| SWP Min Withdrawal | - |

| MER | 1.20% |

|---|---|

| Management Fee | 1.00% |

| Load | No Load |

| FE Max | - |

| DSC Max | - |

| Trailer Fee Max (FE) | - |

| Trailer Fee Max (DSC) | - |

| Trailer Fee Max (NL) | 0.25% |

| Trailer Fee Max (LL) | - |

Join Fund Library now and get free access to personalized features to help you manage your investments.