Try Fund Library Premium

For Free with a 30 day trial!

Alternative Equity Focus

|

NAVPS (06-13-2025) |

$9.15 |

|---|---|

| Change |

-$0.02

(-0.22%)

|

As at May 31, 2025

As at May 31, 2025

Inception Return (October 11, 2024): 1.62%

| Row Heading | Return | Annualized Return | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 Mth | 3 Mth | 6 Mth | YTD | 1 Yr | 2 Yr | 3 Yr | 4 Yr | 5 Yr | 6 Yr | 7 Yr | 8 Yr | 9 Yr | 10 Yr | |

| Fund | -0.39% | 2.86% | 1.20% | 6.96% | - | - | - | - | - | - | - | - | - | - |

| Benchmark | 5.56% | 3.87% | 3.54% | 7.05% | 21.05% | 19.29% | 11.55% | 10.63% | 14.92% | 11.89% | 10.58% | 10.22% | 10.45% | 8.99% |

| Category Average | 3.94% | 0.59% | 0.25% | 2.06% | 8.51% | 12.81% | 7.46% | 5.84% | 9.28% | 7.35% | - | - | - | - |

| Category Rank | 224 / 241 | 59 / 226 | 92 / 212 | 37 / 221 | - | - | - | - | - | - | - | - | - | - |

| Quartile Ranking | 4 | 2 | 2 | 1 | - | - | - | - | - | - | - | - | - | - |

| Return % | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Jan | Feb | Mar | Apr | May |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Fund | - | - | - | - | - | 0.61% | -5.38% | 1.36% | 2.60% | 2.91% | 0.34% | -0.39% |

| Benchmark | -1.42% | 5.87% | 1.22% | 3.15% | 0.85% | 6.37% | -3.27% | 3.48% | -0.40% | -1.51% | -0.10% | 5.56% |

2.91% (March 2025)

-5.38% (December 2024)

| Return % | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|---|---|---|---|

| Fund | - | - | - | - | - | - | - | - | - | - |

| Benchmark | -8.32% | 21.08% | 9.10% | -8.89% | 22.88% | 5.60% | 25.09% | -5.84% | 11.75% | 21.65% |

| Category Average | - | - | - | - | - | 5.11% | 17.27% | -5.96% | 6.54% | 16.58% |

| Quartile Ranking | - | - | - | - | - | - | - | - | - | - |

| Category Rank | - | - | - | - | - | - | - | - | - | - |

-

-

| Name | Percent |

|---|---|

| Canadian Equity | 124.47 |

| Cash and Equivalents | -24.47 |

| Name | Percent |

|---|---|

| Utilities | 49.05 |

| Telecommunications | 39.21 |

| Energy | 36.49 |

| Cash and Cash Equivalent | -24.47 |

| Other | -0.28 |

| Name | Percent |

|---|---|

| North America | 100.00 |

| Name | Percent |

|---|---|

| Telus Corp | 13.50 |

| Rogers Communications Inc Cl B | 13.03 |

| Emera Inc | 12.79 |

| BCE Inc | 12.68 |

| Enbridge Inc | 12.46 |

| TC Energy Corp | 12.28 |

| AltaGas Ltd | 12.25 |

| Fortis Inc | 12.24 |

| Hydro One Ltd | 11.77 |

| Pembina Pipeline Corp | 11.75 |

| Standard Deviation | - | - | - |

|---|---|---|---|

| Beta | - | - | - |

| Alpha | - | - | - |

| Rsquared | - | - | - |

| Sharpe | - | - | - |

| Sortino | - | - | - |

| Treynor | - | - | - |

| Tax Efficiency | - | - | - |

| Volatility | - | - | - |

| Key Ratio | 1 Yr | 3 Yr | 5 Yr | 10 Yr |

|---|---|---|---|---|

| Standard Deviation | - | - | - | - |

| Beta | - | - | - | - |

| Alpha | - | - | - | - |

| Rsquared | - | - | - | - |

| Sharpe | - | - | - | - |

| Sortino | - | - | - | - |

| Treynor | - | - | - | - |

| Tax Efficiency | - | - | - | - |

| Start Date | October 11, 2024 |

|---|---|

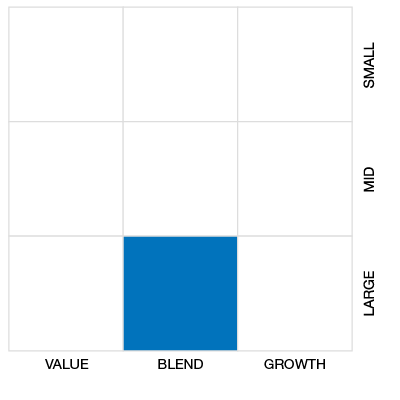

| Instrument Type | Mutual Fund (Alternative) |

| Share Class | Commission Based Advice |

| Legal Status | Trust |

| Sales Status | Open |

| Currency | CAD |

| Distribution Frequency | Monthly |

| Assets ($mil) | - |

| FundServ Code | Load Code | Sales Status |

|---|---|---|

| EVF241 |

The Evolve Fund seeks to replicate, to the extent reasonably possible before fees and expenses, up to a 1.25 times multiple of the performance of the Solactive Canada Utility Index, or any successor thereto (the “Index”), while mitigating downside risk. The Evolve Fund invests primarily in the equity constituents of the Index. To enhance yield, as well as to mitigate risk and reduce volatility, the Evolve Fund will employ a covered call option writing program at the discretion of the Manager.

The Evolve Fund seeks to achieve its investment objective by borrowing cash to invest in and hold a proportionate share of, or a sampling of, the Constituent Securities of the Index in order to track up to approximately 1.25 times the performance of the Index. The Manager believes that option writing may have potential to add value and is an effective way to help lower the level of volatility for an investor and potentially improve returns.

| Portfolio Manager |

Evolve Funds Group Inc. |

|---|---|

| Sub-Advisor |

- |

| Fund Manager |

Evolve Funds Group Inc. |

|---|---|

| Custodian |

CIBC Mellon Trust Company |

| Registrar |

- |

| Distributor |

- |

| RSP Eligible | Yes |

|---|---|

| PAC Allowed | No |

| PAC Initial Investment | - |

| PAC Subsequent | - |

| SWP Allowed | No |

| SWP Min Balance | - |

| SWP Min Withdrawal | - |

| MER | - |

|---|---|

| Management Fee | 1.60% |

| Load | Back Fee Only |

| FE Max | 5.00% |

| DSC Max | - |

| Trailer Fee Max (FE) | 1.00% |

| Trailer Fee Max (DSC) | - |

| Trailer Fee Max (NL) | - |

| Trailer Fee Max (LL) | - |

Try Fund Library Premium

For Free with a 30 day trial!