Try Fund Library Premium

For Free with a 30 day trial!

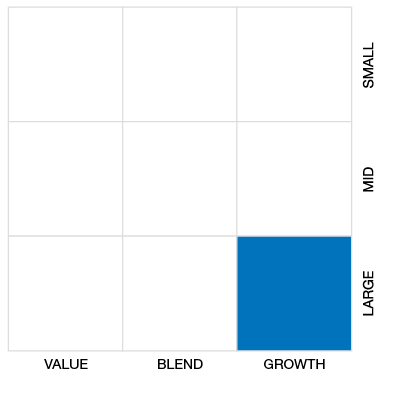

Global Small/Mid Cap Eq

Click for more information on Fundata’s FundGrade

Click for more information on Fundata’s FundGrade

Click for more information on Fundata’s FundGrade.

2022, 2021, 2020, 2019

Click for more information on Fundata’s FundGrade

|

NAVPS (06-30-2025) |

$41.87 |

|---|---|

| Change |

-$0.28

(-0.66%)

|

As at May 31, 2025

As at May 31, 2025

Inception Return (February 02, 1998): 8.10%

| Row Heading | Return | Annualized Return | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 Mth | 3 Mth | 6 Mth | YTD | 1 Yr | 2 Yr | 3 Yr | 4 Yr | 5 Yr | 6 Yr | 7 Yr | 8 Yr | 9 Yr | 10 Yr | |

| Fund | 4.61% | -6.87% | -9.93% | -6.41% | 9.95% | 13.42% | 10.11% | 1.75% | 7.16% | 7.83% | 7.61% | 9.05% | 9.53% | 8.59% |

| Benchmark | 5.68% | -1.75% | -4.06% | -1.05% | 9.42% | 14.83% | 10.76% | 5.74% | 10.79% | 8.77% | 6.88% | 7.29% | 8.61% | 7.52% |

| Category Average | 5.70% | 0.86% | -0.91% | 1.66% | 6.63% | 11.23% | 8.33% | 2.85% | 8.85% | 7.08% | 4.89% | 5.05% | 6.09% | 4.95% |

| Category Rank | 234 / 281 | 265 / 281 | 259 / 278 | 256 / 279 | 94 / 269 | 95 / 258 | 90 / 233 | 139 / 222 | 138 / 193 | 95 / 171 | 30 / 145 | 6 / 134 | 10 / 127 | 10 / 113 |

| Quartile Ranking | 4 | 4 | 4 | 4 | 2 | 2 | 2 | 3 | 3 | 3 | 1 | 1 | 1 | 1 |

| Return % | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Jan | Feb | Mar | Apr | May |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Fund | 2.62% | 5.08% | 0.21% | 3.98% | 0.07% | 8.57% | -3.77% | 7.79% | -6.77% | -8.16% | -3.06% | 4.61% |

| Benchmark | -1.02% | 5.44% | -1.29% | 3.07% | 0.86% | 6.51% | -3.05% | 4.42% | -3.55% | -4.14% | -3.02% | 5.68% |

31.54% (February 2000)

-16.87% (September 2008)

| Return % | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|---|---|---|---|

| Fund | 21.14% | -7.27% | 22.76% | 1.23% | 23.61% | 36.90% | 15.71% | -29.71% | 22.05% | 17.51% |

| Benchmark | 16.61% | 7.47% | 15.40% | -7.34% | 20.09% | 11.07% | 15.50% | -13.14% | 14.59% | 18.68% |

| Category Average | 9.56% | 3.48% | 12.62% | -10.42% | 13.76% | 14.53% | 12.37% | -15.59% | 12.82% | 12.04% |

| Quartile Ranking | 2 | 4 | 1 | 1 | 1 | 1 | 2 | 4 | 1 | 2 |

| Category Rank | 39/ 101 | 125/ 127 | 11/ 132 | 2/ 142 | 36/ 168 | 22/ 174 | 84/ 209 | 192/ 231 | 34/ 248 | 74/ 266 |

36.90% (2020)

-29.71% (2022)

| Name | Percent |

|---|---|

| US Equity | 59.40 |

| International Equity | 39.28 |

| Cash and Equivalents | 1.32 |

| Name | Percent |

|---|---|

| Technology | 29.29 |

| Industrial Services | 13.55 |

| Consumer Services | 11.05 |

| Consumer Goods | 10.48 |

| Financial Services | 10.14 |

| Other | 25.49 |

| Name | Percent |

|---|---|

| North America | 60.72 |

| Asia | 26.62 |

| Europe | 9.09 |

| Africa and Middle East | 3.57 |

| Name | Percent |

|---|---|

| HealthEquity Inc | 4.29 |

| MonotaRO Co Ltd | 4.24 |

| Shift4 Payments Inc Cl A | 4.09 |

| BayCurrent Consulting Inc | 3.90 |

| Ensign Group Inc | 3.80 |

| RBC Bearings Inc | 3.27 |

| Casella Waste Systems Inc Cl A | 2.99 |

| Trex Co Inc | 2.80 |

| Nova Ltd | 2.53 |

| Bellring Brands Inc Cl A | 2.49 |

Renaissance Global Small-Cap Fund Class A

Median

Other - Global Small/Mid Cap Eq

| Standard Deviation | 19.58% | 18.80% | 18.00% |

|---|---|---|---|

| Beta | 1.18% | 1.20% | 1.14% |

| Alpha | -0.02% | -0.05% | 0.00% |

| Rsquared | 0.86% | 0.81% | 0.81% |

| Sharpe | 0.39% | 0.33% | 0.45% |

| Sortino | 0.73% | 0.45% | 0.57% |

| Treynor | 0.06% | 0.05% | 0.07% |

| Tax Efficiency | 100.00% | 100.00% | 100.00% |

| Volatility |

|

|

|

| Key Ratio | 1 Yr | 3 Yr | 5 Yr | 10 Yr |

|---|---|---|---|---|

| Standard Deviation | 18.96% | 19.58% | 18.80% | 18.00% |

| Beta | 1.26% | 1.18% | 1.20% | 1.14% |

| Alpha | -0.01% | -0.02% | -0.05% | 0.00% |

| Rsquared | 0.85% | 0.86% | 0.81% | 0.81% |

| Sharpe | 0.40% | 0.39% | 0.33% | 0.45% |

| Sortino | 0.67% | 0.73% | 0.45% | 0.57% |

| Treynor | 0.06% | 0.06% | 0.05% | 0.07% |

| Tax Efficiency | 100.00% | 100.00% | 100.00% | 100.00% |

| Start Date | February 02, 1998 |

|---|---|

| Instrument Type | Mutual Fund |

| Share Class | Commission Based Advice |

| Legal Status | Trust |

| Sales Status | Open |

| Currency | CAD |

| Distribution Frequency | Annual |

| Assets ($mil) | $861 |

| FundServ Code | Load Code | Sales Status |

|---|---|---|

| ATL1040 | ||

| ATL1041 | ||

| ATL2041 |

The Fund's objective is to seek long-term growth through capital appreciation consistent with preservation of capital through investment primarily in the common shares of smaller, less established companies in developed markets around the world. The Fund may also invest in smaller, less established companies in less developed markets around the world, and may invest in companies that are suppliers or clients of smaller companies.

To achieve its investment objectives, the Fund: invests based on a bottom-up approach, with an emphasis on growth. The portfolio sub-advisor looks for companies with well-articulated business plans, experienced management, a sustainable competitive advantage, and strong financial characteristics when selecting investments for the Fund. The portfolio sub-advisor will also apply valuation analysis to identify those companies with attractive fundamental, growth and valuation characteristics.

| Portfolio Manager |

CIBC Asset Management Inc. |

|---|---|

| Sub-Advisor |

Wasatch Global Investors |

| Fund Manager |

CIBC Asset Management Inc. |

|---|---|

| Custodian |

CIBC Mellon Trust Company |

| Registrar |

CIBC Asset Management Inc. |

| Distributor |

- |

| RSP Eligible | Yes |

|---|---|

| PAC Allowed | Yes |

| PAC Initial Investment | 500 |

| PAC Subsequent | 50 |

| SWP Allowed | Yes |

| SWP Min Balance | 10,000 |

| SWP Min Withdrawal | 50 |

| MER | 2.21% |

|---|---|

| Management Fee | 1.80% |

| Load | Choice of Front or No Load |

| FE Max | 5.00% |

| DSC Max | - |

| Trailer Fee Max (FE) | 1.00% |

| Trailer Fee Max (DSC) | 1.00% |

| Trailer Fee Max (NL) | - |

| Trailer Fee Max (LL) | - |

Try Fund Library Premium

For Free with a 30 day trial!