Join Fund Library now and get free access to personalized features to help you manage your investments.

International Equity

Click for more information on Fundata’s FundGrade

Click for more information on Fundata’s FundGrade

Click for more information on Fundata’s FundGrade.

Click for more information on Fundata’s ESG Grade

Click for more information on Fundata’s ESG Grade

Click for more information on Fundata’s ESG Grade.

|

NAVPS (05-15-2024) |

$22.90 |

|---|---|

| Change |

$0.13

(0.56%)

|

As at April 30, 2024

As at April 30, 2024

As at February 29, 2024

Inception Return (April 28, 2000): 3.83%

| Row Heading | Return | Annualized Return | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 Mth | 3 Mth | 6 Mth | YTD | 1 Yr | 2 Yr | 3 Yr | 4 Yr | 5 Yr | 6 Yr | 7 Yr | 8 Yr | 9 Yr | 10 Yr | |

| Fund | -0.88% | 8.89% | 22.18% | 11.93% | 17.35% | 14.01% | 8.63% | 13.72% | 10.28% | 9.10% | 9.12% | 10.35% | 9.23% | 10.18% |

| Benchmark | -1.23% | 5.31% | 17.50% | 6.26% | 10.76% | 11.78% | 5.22% | 10.18% | 6.31% | 5.21% | 5.71% | 7.58% | 6.13% | 6.78% |

| Category Average | -1.59% | 15.49% | 15.49% | 5.35% | 7.84% | 9.70% | 3.19% | 8.71% | 5.16% | 4.41% | 4.71% | 6.36% | 4.81% | 5.42% |

| Category Rank | 250 / 780 | 21 / 776 | 12 / 770 | 16 / 772 | 28 / 741 | 49 / 723 | 50 / 697 | 45 / 658 | 12 / 621 | 17 / 542 | 12 / 482 | 16 / 429 | 4 / 369 | 3 / 345 |

| Quartile Ranking | 2 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 | 1 |

| Return % | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | Jan | Feb | Mar | Apr |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Fund | -2.56% | 3.04% | 1.14% | -1.23% | -2.69% | -1.60% | 6.14% | 2.84% | 2.79% | 4.45% | 5.19% | -0.88% |

| Benchmark | -3.45% | 1.52% | 3.11% | -1.30% | -3.65% | -1.92% | 7.38% | 2.98% | 0.90% | 3.40% | 3.12% | -1.23% |

9.22% (November 2022)

-14.22% (September 2008)

| Return % | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|---|---|---|---|---|

| Fund | 3.84% | 21.56% | -0.25% | 21.84% | -9.32% | 23.53% | 9.73% | 28.59% | -16.49% | 15.92% |

| Benchmark | 4.12% | 19.41% | -1.70% | 18.37% | -6.81% | 16.27% | 8.01% | 8.97% | -10.67% | 15.74% |

| Category Average | 1.55% | 13.82% | -2.56% | 17.84% | -8.91% | 17.54% | 7.87% | 8.64% | -12.60% | 13.75% |

| Quartile Ranking | 2 | 1 | 2 | 1 | 3 | 1 | 2 | 1 | 4 | 2 |

| Category Rank | 121/ 325 | 70/ 363 | 146/ 408 | 68/ 468 | 314/ 531 | 102/ 599 | 290/ 653 | 2/ 684 | 585/ 707 | 206/ 735 |

28.59% (2021)

-16.49% (2022)

| Name | Percent |

|---|---|

| International Equity | 98.24 |

| Cash and Equivalents | 1.76 |

| Name | Percent |

|---|---|

| Industrial Goods | 20.78 |

| Financial Services | 15.64 |

| Consumer Goods | 12.98 |

| Consumer Services | 10.89 |

| Healthcare | 10.27 |

| Other | 29.44 |

| Name | Percent |

|---|---|

| Europe | 82.36 |

| Asia | 16.07 |

| North America | 1.57 |

| Name | Percent |

|---|---|

| Novo Nordisk A/S Cl B | 5.34 |

| Shell PLC | 4.74 |

| Sap SE | 3.94 |

| Industria de Diseno Textil SA | 3.79 |

| Caixabank SA | 3.30 |

| BAE Systems PLC | 3.19 |

| Cie de Saint Gobain SA | 3.08 |

| Beiersdorf AG | 2.85 |

| Ferrari NV | 2.84 |

| Airbus SE | 2.71 |

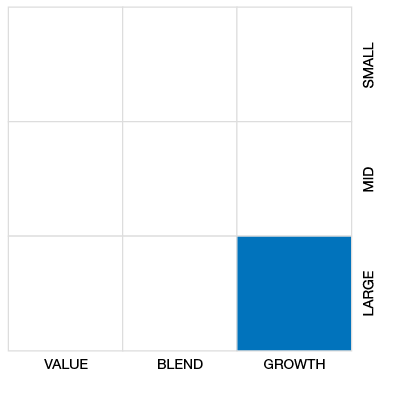

International Equity Growth Pool Class W

Median

Other - International Equity

| Standard Deviation | 14.60% | 13.65% | 12.20% |

|---|---|---|---|

| Beta | 1.00% | 0.91% | 0.89% |

| Alpha | 0.03% | 0.04% | 0.04% |

| Rsquared | 0.83% | 0.83% | 0.83% |

| Sharpe | 0.45% | 0.64% | 0.74% |

| Sortino | 0.65% | 0.84% | 0.92% |

| Treynor | 0.07% | 0.10% | 0.10% |

| Tax Efficiency | 84.95% | 91.07% | 94.52% |

| Volatility |

|

|

|

| Key Ratio | 1 Yr | 3 Yr | 5 Yr | 10 Yr |

|---|---|---|---|---|

| Standard Deviation | 10.77% | 14.60% | 13.65% | 12.20% |

| Beta | 0.88% | 1.00% | 0.91% | 0.89% |

| Alpha | 0.07% | 0.03% | 0.04% | 0.04% |

| Rsquared | 0.87% | 0.83% | 0.83% | 0.83% |

| Sharpe | 1.10% | 0.45% | 0.64% | 0.74% |

| Sortino | 2.82% | 0.65% | 0.84% | 0.92% |

| Treynor | 0.13% | 0.07% | 0.10% | 0.10% |

| Tax Efficiency | 94.95% | 84.95% | 91.07% | 94.52% |

The E, S, and G scores are averaged for each security in the portfolio, to arrive at an ESG score for each security. We take the portfolio weighted average of the ESG scores for each fund and rank them against their peers to arrive at the Fundata ESG Score from 0-100.

Three scores under the Environment bucket are averaged to yield the Fundata Environment Score for each fund from 0-100: (1) Pollution Prevention, (2) Environmental Transparency, (3) Resource Efficiency.

Six scores under the Social bucket are averaged to yield the Fundata Social Score for each fund from 0-100. (1) Compensation and Satisfaction, (2) Diversity and Rights, (3) Education and Work Conditions, (4) Community and Charity, (5) Human Rights, (6) Sustainability Integration.

Three scores under the governance bucket are averaged to yield the Fundata Governance Score for each fund from 0-100: (1) Board Effectiveness, (2) Management Ethics, (3) Disclosure and Accountability.

Powered by OWL Analytics. For more information, please contact Fundata Canada.

| Start Date | April 28, 2000 |

|---|---|

| Instrument Type | Mutual Fund |

| Share Class | Commission Based Advice |

| Legal Status | Trust |

| Sales Status | Open |

| Currency | CAD |

| Distribution Frequency | Annual |

| Assets ($mil) | - |

| FundServ Code | Load Code | Sales Status |

|---|---|---|

| CIG1366 | ||

| CIG1566 | ||

| CIG9616 | ||

| CIG9666 | ||

| CIG9716 | ||

| CIG9766 | ||

| CIG9816 | ||

| CIG9866 |

The investment objective of the International Equity Growth Pool is to provide long-term capital appreciation primarily through investments in a diversified portfolio of equity and equity-related securities of international issuers which are believed to offer above-average growth potential. Equity-related securities include convertible preferred shares, convertible debt obligations and warrants. Any change to

The portfolio adviser looks for those companies that are believed to have a reasonable prospect of above-average earnings growth or long-term capital appreciation.

| Name | Start Date |

|---|---|

| CI Investments Inc | 12-03-2020 |

| CI Global Investments Inc | 12-03-2020 |

| Fund Manager | CI Investments Inc |

|---|---|

| Advisor | CI Investments Inc |

| Custodian | RBC Investor Services Trust (Canada) |

| Registrar | CI Investments Inc |

| Distributor | Assante Capital Management Ltd. |

| Auditor | Ernst & Young LLP |

| RSP Eligible | Yes |

|---|---|

| PAC Allowed | Yes |

| PAC Initial Investment | 50 |

| PAC Subsequent | 50 |

| SWP Allowed | Yes |

| SWP Min Balance | 5,000 |

| SWP Min Withdrawal | 50 |

| MER | 0.18% |

|---|---|

| Management Fee | 2.50% |

| Load | Choice of Front or No Load |

| FE Max | 4.00% |

| DSC Max | 5.50% |

| Trailer Fee Max (FE) | 0.85% |

| Trailer Fee Max (DSC) | 0.50% |

| Trailer Fee Max (NL) | - |

| Trailer Fee Max (LL) | - |

Join Fund Library now and get free access to personalized features to help you manage your investments.